How to pay independent contractors

No Credit Card Required.

The recent surge in the virtual workstream shaped the world radically. Nowadays, being an inhabitant of a small Asian country, you may be considering hiring employees for yourself, even from a North American behemoth like Canada (if you pay them accordingly, of course!). The boundary is not an issue now, nor is the difference in any other parameter. Yet, while paying these independent contractors, many employers face issues despite all the facilities we are enjoying leveraging these tech globalization impacts.

This article will discuss everything related to independent contractors, their payment methods and terminologies, steps on how to pay them, and how Apploye can help you facilitate payment of independent contractors.

Who is an independent contractor?

Put another way, a person who delivers services to a company based on a contract is considered an independent contractor. Freelancers or independent contractors provide their services to a company ad hoc only when there is a need for their expertise.

Freelancers and independent contractors share many similarities; nonetheless, there are substantial legal distinctions between the two. As a result of the fact that they are typically outsourced to specific clients by a base agency or corporation, they have significantly less autonomy in terms of the clients and projects they choose to work on.

Paying independent contractors can be tricky as the newbies can entangle the processes, methods can be complicated, and tax laws across countries can vary to large degrees.

Why should you use independent contractors?

Many companies nowadays hire independent contractors for various reasons, from talent diversification to leveraging the economy of scale for their business. Below are the reasons why you might need to use independent contractors.

- Flexibility: Independent contractors' payments are comparatively lower than permanent employees. Independents move on to new contracts after completing a project, which is a point of spectacular flexibility.

- Competitive Advantage: Companies can modify the size of the workforce following their growth and goal setting by hiring independent contractors. Bypassing the cost of hiring and training a person for the same job can give them competitive advantages over their peers.

- Managerial requirement is minimal: Because independent contractors have separate legal entities, it is up to them to determine how, when, and where they will carry out the job stipulated in their contracts. They will still be required to report to a manager, but compared to regular employees, they require far less supervision.

- Increased Productivity and efficiency: Independent contractors enable businesses to become more adaptable, enhancing supply chain management and overall productivity. Because their employment consists only of developing and executing solutions to problems, they tend to achieve their objectives more quickly than typical workers.

- Decreased Liabilities: Employers are not liable for independent contractor injuries, wrongful termination, job discrimination, or sexual harassment lawsuits. State and federal laws regulate many of these areas, so employers may still be liable.

Although there are some downsides to hiring an independent contractor, the advantages of hiring them are way more prominent.

Independent Contractor Payment Terminology

Before moving on to paying an independent contractor, it is highly recommended that you know the terminologies related to paying them. Below are some of them.

- Net 10, 30, and 60: Net 10, Net 30, or Net 60 indicates that the contractor's payment is due 10, 30, or 60 days respectively.

- Prepayment: A prepayment may be provided in advance for the outstanding balance of a liability, or a portion payment of a bigger loan made before the due date.

- End of Month: When you hear this term, it signifies that the paying firm is obligated to send payment by the last day of the month in which they receive the invoice from the contractor.

- W-2 Contractor: An individual is considered a W-2 contractor if a temporary employment agency gives them a Form W-2. Still, they perform their services as contractors for the agency's customers

- W-9 Form: Employers and other institutions can use the IRS's W-9 US to verify a recipient's name, address, and taxpayer identification number.

Independent Contractor Payment Methods

You may wish to take into consideration one of the following options if you are trying to decide which payment method is the most appropriate to employ when paying your contractor:

- Wire transfer: Due to their speed, wire transfers are a fantastic choice for payments that must be sent immediately. A local wire transfer typically takes 24 hours, but an overseas transfer may take a few days. If you live in the United Kingdom, you can use Bacs payments to transfer funds from one bank to another. There are plenty of benefits to using Bacs payments, including its safety and reliability.

- Freelance management systems (FMS): A Freelance Management System (FMS) controls all operational, financial, and legal aspects of dealing with freelancers to eliminate paperwork and enhance productivity. It streamlines and simplifies every process—from hiring to compliance—so you can start to work quickly and improve results.

- Accounting software: There are popular accounting software that can facilitate the payment of freelancers, such as QuickBooks, FreshBooks, Google Wallet, etc. Nowadays, self-employed accounting solutions are gaining traction for their tailored features catering directly to the needs of independent contractors and freelancers. As a result, these improve the efficiency of their financial management processes effectively.

- Credit Card: Payments made with credit cards are attractive for several reasons, including the fact that they are exceptionally safe and frequently simple to reverse. It is possible that this option will not be available to you since your contractor needs to have a merchant account with the bank or some alternative merchant service for you to pay them using a credit card. However, once a business has a setup in place, it can easily accept credit card payments, whether the merchant is an independent contractor or a general contractor.

- Various Online payment systems: Online payment systems around the world can help you pay independent contractors. The most extensive online payment system in the world is PayPal. It's a well-liked option for paying freelancers because it manages currency conversions, issues payments quickly, and is safe.

- With the help of Wise's online payment app, individuals and companies may transmit amounts quickly and securely. Tipalti is a global payment automation solution comparable to Payoneer and PayPal.

- Another excellent option for online payments is Venmo, which allows independent contractors to receive payments fast and securely to their Venmo accounts and then transfer the funds to their linked bank accounts.

Mistakes people make while paying independent contractors

Handling the employees is not an easy task however, the regulations in an organization can make the work easier for the managers. But while paying and handling the independent contractors there might be mistakes that you should be aware of. Below are some of them:

- Managing no written contracts: You require an independent contractor agreement if you work with an independent contractor. Businesses mistakenly view Independent contractor agreements as a nice-to-have rather than a requirement. As a result, having a properly worded contract with contractors is a good idea and a need for legal compliance.

- Treating independent contractors as the same as employees: You cannot prevent the contractor from working for whoever they choose to work for, nor can you instruct the contractor to adhere to particular hours or work a predetermined number of hours each week. Having deadlines within specific parameters is acceptable but requiring that others adhere to distinct timetables is unacceptable.

- No regular monitoring and supervision: The establishment of timeframes is inextricably linked to this step. It would be best if you made sure that the independent contractor you have hired is proceeding as planned and possesses all of the resources required to complete the assignment you assigned to them successfully.

So have some time on your hand to monitor their work and keep an eye on how they are performing from time to time. - No direct policy towards independent contractor’s works: The policies of different companies will vary, but a good policy should describe the distinctions between an employee and an independent contractor, as well as the standards that must be met for your company to engage the services of a contractor who works independently.

This may include the types of projects you delegate to an independent contractor and the level of support you are legally allowed to provide. So, make the policies towards independent contractors’ crystal clear to get the best work out of them without hassles. - Working with independent contractors who don't adhere to business protocol: State law prohibits independent contractors from operating without one essential company obligation, like registering to pay taxes, setting up a home office, and keeping business documents. Businesses are often astonished to realize that independent contractors' business decisions might affect them. So, don't hire someone who doesn’t respect your company's rules.

Challenges of managing independent contractors

Not all companies want to take on the challenges of hiring and managing independent employees. The challenges of managing freelancers could be an uphill battle for most companies.

Below are some challenges of managing the independent contractor that you should be aware of:

- Adhering to local labor laws: Contractors must be government-registered to work independently in some sectors. Other sectors or places may pertain to a different law. Thus, follow local contractor laws. Make sure your partner has the worldwide legal infrastructure to monitor changing regulations in all the countries where you recruit contractors if your company doesn't have the resources.

- Tax Implications: Because they are exempt from providing benefits or paying taxes, many people believe that hiring independent contractors is the best option. Independent contractors, who should only be working for a short time, should not require benefits and should pay their taxes. Additionally, the independent contractor should not be working for an extended period.

- The uncertainty with assurance: Hiring an independent contractor who is not licensed or referred poses a risk in and of itself, even if all other possible dangers are avoided. A contractor is ultimately only as good as their word, regardless of whether you ask for a portfolio or work samples, give tests, or do interviews.

- Lesser Control, Greater Risk: Because independent contractors are not considered to be employees, they are granted a certain amount of autonomy, which prohibits them from being able to interfere too much in their work. Again, you put yourself in danger of a new set of liabilities, which are far simpler to avoid if you hire people full-time.

Steps on How to Pay Independent Contractors

Paying out independent contractors is one of the trickiest jobs you may encounter, yet a systematic approach can get rid of the maze and make the payment process a breeze if you learn how to follow that.

Below are the seven steps you should follow while paying the hired independent contractor.

Step 1: Learn to differentiate between an employee and an independent contractor

It might sound bizarre but believe me, it’s one of the cornerstones you should consider while moving forward to pay the independent contractor.

An independent contractor is a self-employed person who is often engaged to finish a short-term project without any responsibilities to work for the company on an ongoing basis. This worker type is typically called an "independent contractor."

In most cases, the individual in question is not a member of the organization's permanent workforce and, as a result, does not qualify for the benefits provided by the employer, such as paid sick leave, vacation time, or health insurance coverage.

On the other hand, a worker is referred to as an employee when employed by a company and has the same responsibilities as paid-wage employment.

Now why is such a distinction necessary? Because learning to treat these two types of entities is a monstrous task, given an employee is subjected to various rights and obligations which doesn’t apply to the case of an independent contractor. So, while making the payment procedure and frequency, you must consider certain aspects that impact the payment.

Step 2: Payment rate and frequency

A company will typically negotiate a rate with a contractor in advance, on an hourly or per-project basis, depending on the circumstances. In some instances, a contractor might be put on retainer, which indicates that they are paid a specific sum for ongoing labor and serves as a synonym for the phrase "placed on retainer."

There may be variations in payment schedules from one company to the next for independent contractors that work for them. There is no one set rule for how you will handle the payment frequency, but you need to keep a close eye on your company's cash flow and income stream to get a clear picture of how frequently you are going to pay the contractors. There is no one set rule for how you are going to manage the payment frequency.

Let's say you run a large company that doesn't outsource very often, but there's a chance you'll need some temporary help in the next few days. You have the option of paying the independent contractors on a daily or weekly basis, seeing as how the company's financial situation is relatively steady.

A business that works on various projects and hires independent contractors for those projects should give thought to the possibility of paying the independent contractors on a project-by-project basis.

If, on the other hand, you run a small business that has not yet established itself as successful in its industry and the cash flow you create is not robust, it is a good idea to choose either a monthly payment or a one-time payment option.

Step 3: Filling out a W-9 form

The Internal Revenue Service (IRS) delivers a formal document known as the W-9 to employers and other organizations so that those parties can confirm the name, address, and taxpayer identification number of a person receiving income. The contractor and the business have an agreement stating that the contractor is not an employee and is not subject to withholding taxes.

Once you receive the W-9 Form, you are able to begin setting up contractors in your payroll system, which could be a notebook, Microsoft Excel, or payroll software. Once you have the W-9 Form, you are able to do this.

When you have completed all of these steps, you will be able to pay your independent contractors. At the beginning of the payroll process, before you do anything else, you must make sure that you have documented all of the information about your independent contractors. Doing so will help you avoid any problems on payday.

The following information your employees have to fill out in the W-9 form:

- Name

- Type of business

- Certification

- Taxpayer Identification Number (TIN)

Step 4: Payment Calculation

Suppose a contractor invoices their clients on an hourly basis. In that case, they are obligated to declare the whole number of hours worked on a project, including even the number of half or quarter hours done, within the time limit agreed upon for payment.

In addition to this, they should list, at the very least on a high level, the services that are done during certain hours. After that, you must multiply the number of hours worked by their hourly wage.

If, on the other hand, they are paid per project, the charge will have been established in advance regardless of the length of time it takes to complete the work. In this situation, it is not unusual to pay a percentage of the money upfront to guarantee the job, such as 15 percent of the total fee, and then spend the remaining balance once the project is finished.

Step 5: Payment Processing

You should be able to upload a spreadsheet containing payment data in order to conduct bulk payments using a payroll solution that can manage direct deposits for a large number of independent contractors.

Your business systems can send payment data to payroll platforms via API. Your IT teams will need to integrate with theirs, but you can seek API documentation to determine how much it will boost your firm.

Direct deposit uses ACH networks to deposit money into a contractor's bank account. Direct deposit for 1099 workers requires authorization. So, collect their bank account number, routing number, checking or savings account type, and transaction type (one-time, recurring).

Step 6: Preserving data through a General Ledger

A general ledger sheet collects information about all contractors your company has paid in one location to make it simple to locate information when needed. This may be a separate tab on your payment log that tracks contractors' yearly gross income so you can quickly determine which employees you'll need to prepare 1099s for. In this spreadsheet, you can keep track of things like commission rates, variable pay rates, and other details that are particular to each contractor.

Step 7: 1099 tax documents preparation

If their business is not an S Corp or a C Corp, they must fill out a Form 1099-NEC for any non-employee payment over $600. You must send the form to the IRS by mail or electronically by January 31 and give the contractor a copy by the same date.

If you're considering using a payroll platform to pay your contractors, look for one that will send your 1099s to the IRS and send the 1099s to your workers electronically. This will save you a lot of time since you won't have to mail copies of the forms by hand.

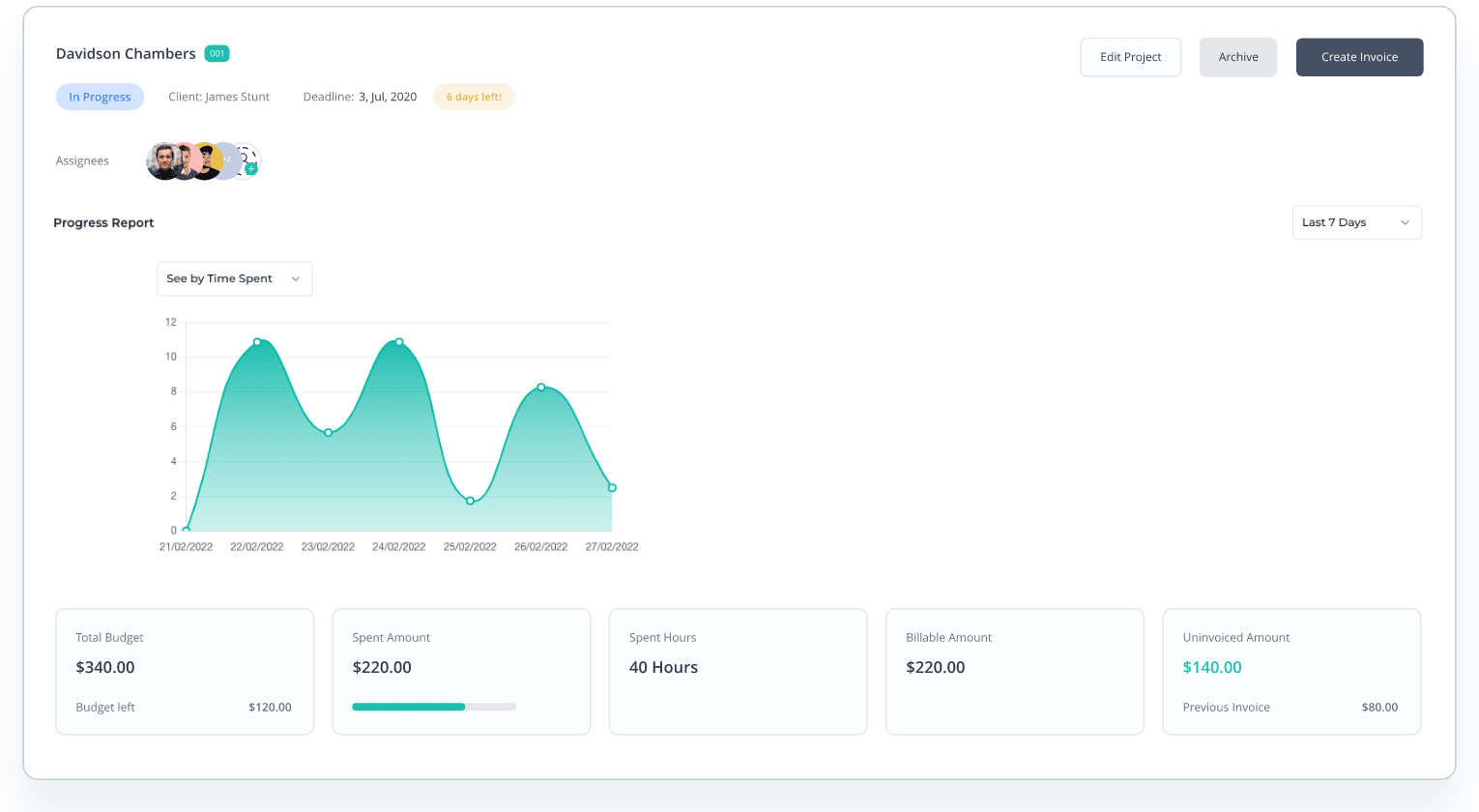

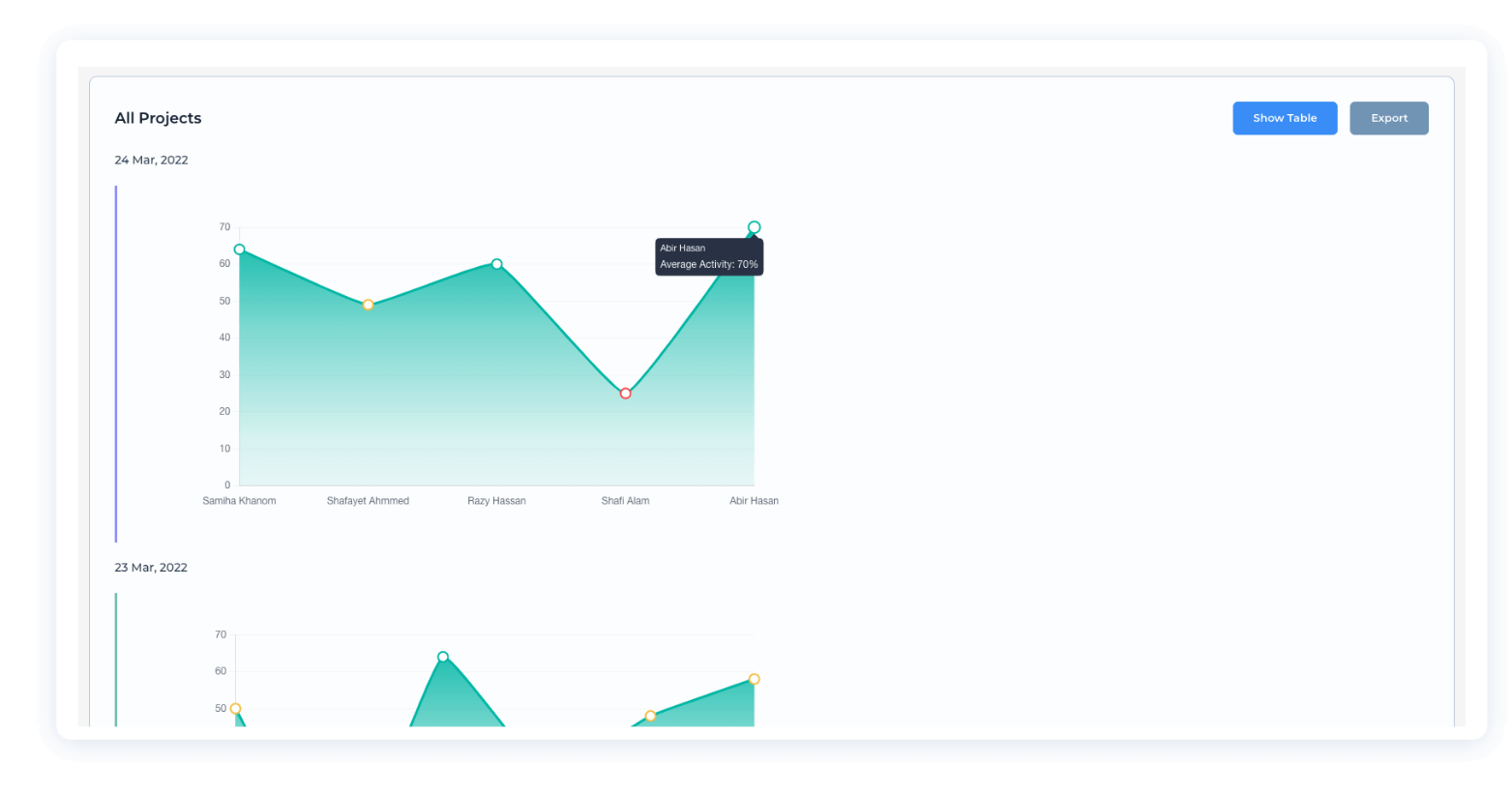

Apploye- Tool that facilitates payment of independent contractors

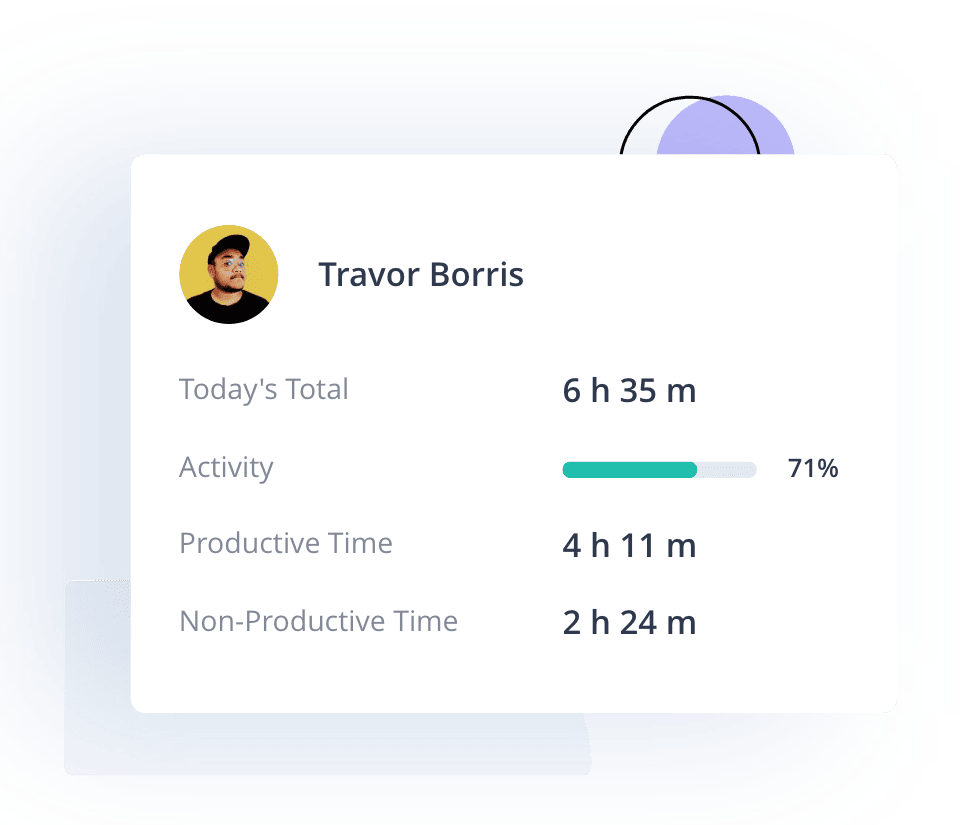

One of the finest time tracking software you will have is Apploye which can track the time and monitor the employees most sensibly. We suggest this tool if you need to monitor the works of independent contractors or keep an accurate calculation for payroll management. In addition, you can save a precise estimate of the billable and non-billable hours of the contractors working for your company.

How Apploye helps you facilitate managing independent contractors?

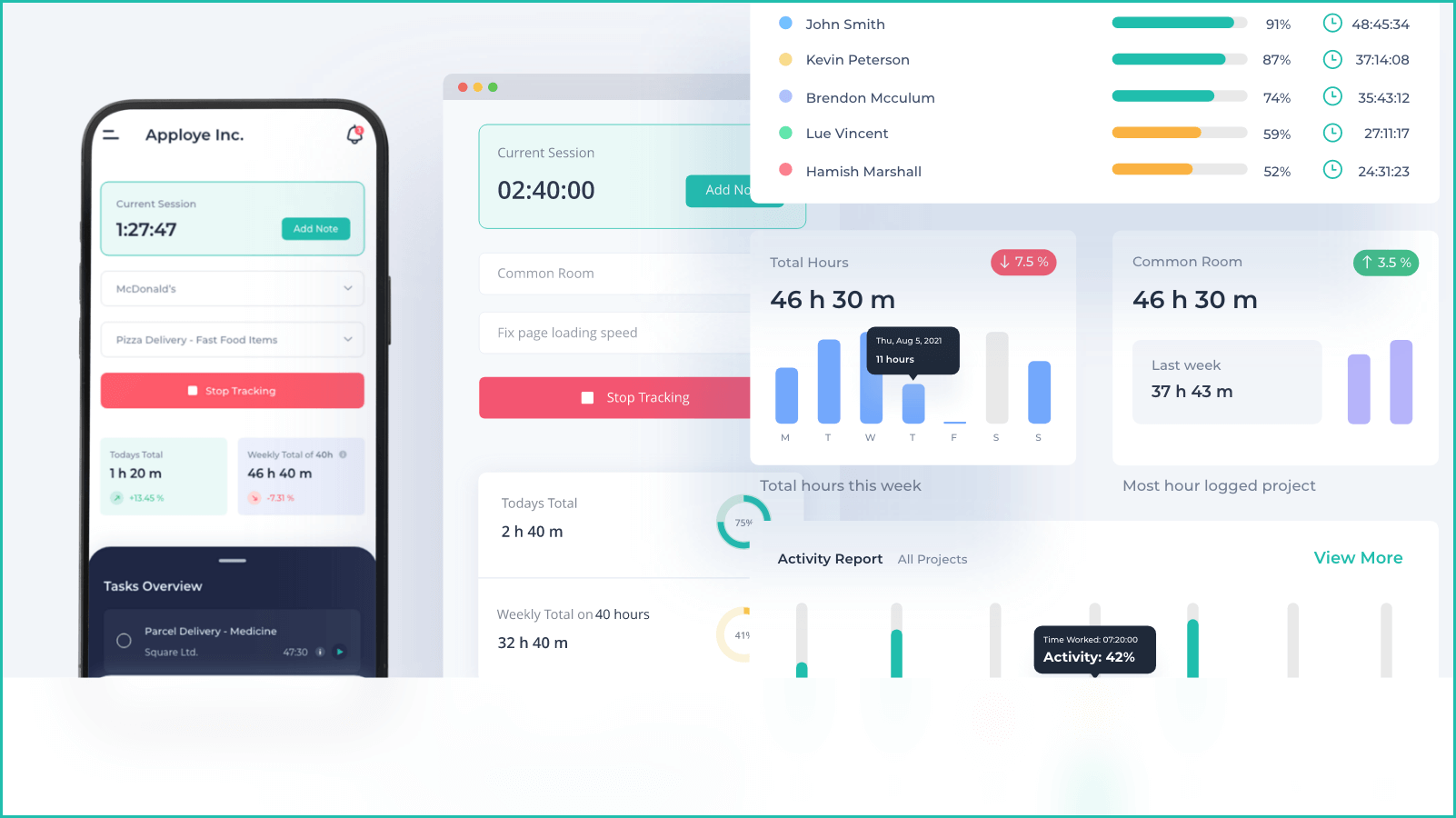

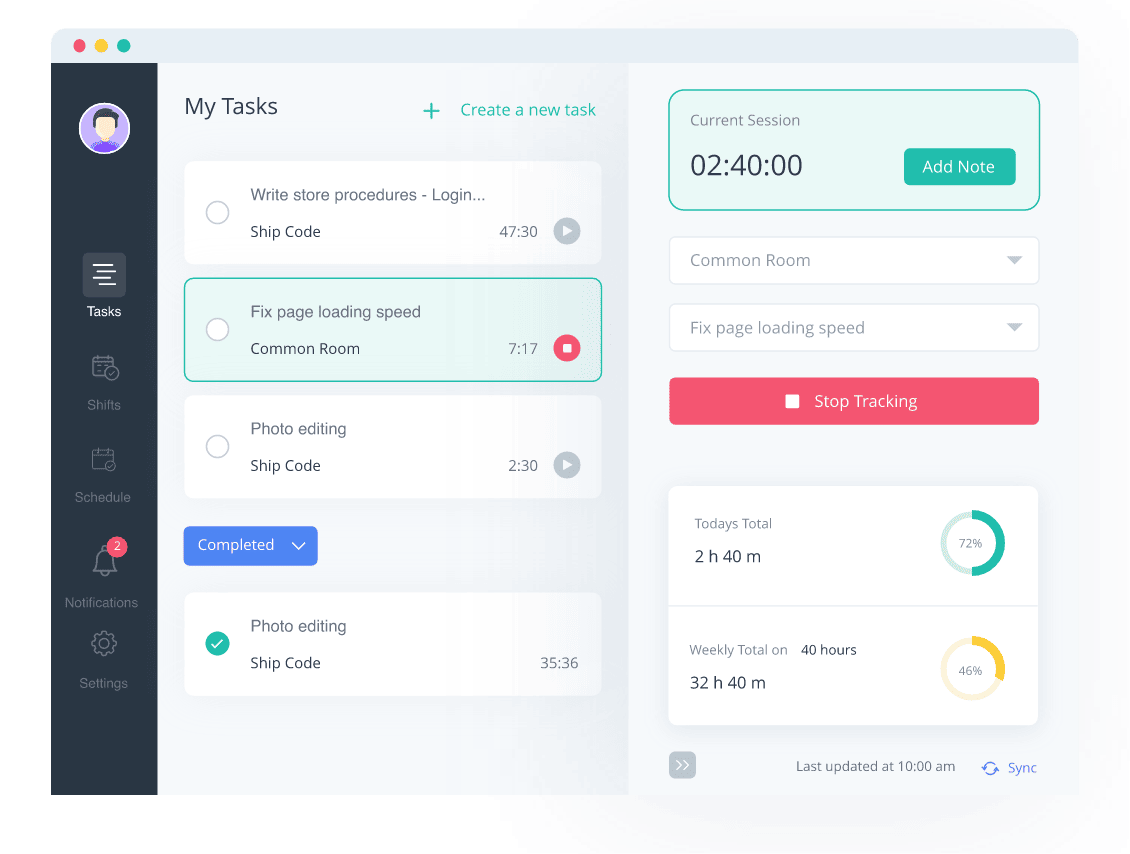

Under the quiver of Apploye, the following features can enable you to track the work progress of freelancers and independent contractors and avoid any payment-related issues.

- Time tracking: Apploye helps you track the time of your independent contractors and keep a record on how much time they have worked for you.

- Billable and Non-Billable Hours: You can utilize Apploye to include or exclude particular projects from the computation of the billable amount when you are determining the amount that has to be paid to independent contractors.

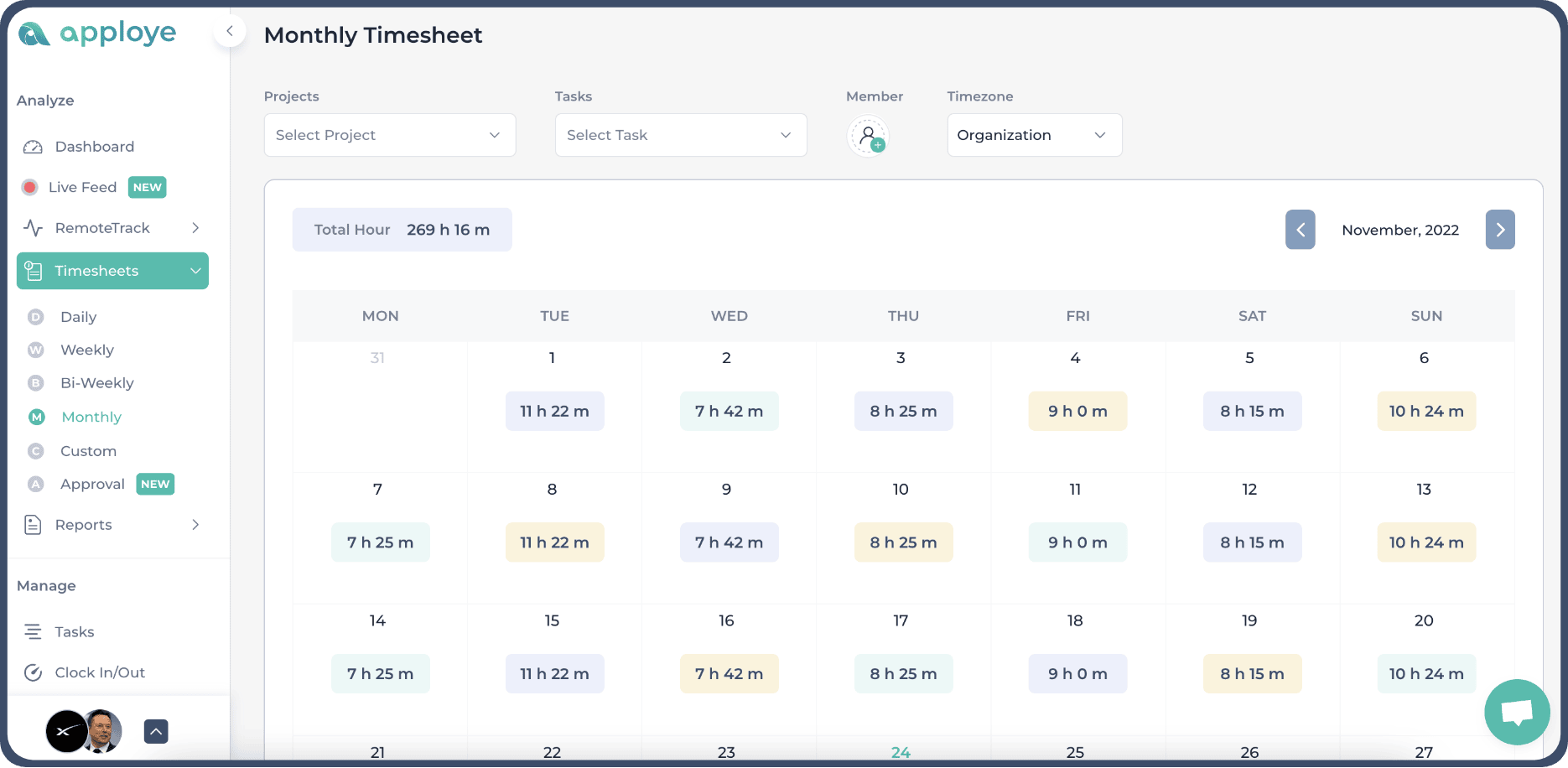

- Timesheet Approval: You can review and approve the timesheets of your independent contractors using Apploye on a daily, weekly, or custom basis, depending on business needs.

- Weekly Limit: You have the ability to limit the number of hours that independent contractors work each week. Your independent contractors won't be able to continue tracking their time when they reach the weekly time restriction you've set for them.

- Random Screenshots: The Apploye desktop timer randomly captures screenshots every 10 minutes. You may also configure up to three screenshots each 10 minutes in settings. Manage remote independent contractors using this feature.

- Apps and URL tracking: Businesses can benefit from this RemoteTrack feature. The apps' usage and URL tracking may show managers how and where employees spend their time, what software they use, and what websites they visit during work hours. It's a unique feature if you supervise remote employees and independent contractors.

Apart from these features, Apploye offers more to the businesses, which they can leverage to track and monitor the works of the independent contractors under them.

Getting started with Apploye

To start using Apploye follow the steps mentioned below:

Step 1: Open an account with Apploye

Create your organization after subscribing. Set the Timezone and then click "Join an Existing Organization." Add a project, select a plan, and click "Next." Begin by inviting people to join.

Step 2: Create projects and assign participants

Using the Apploye Web app, navigate to "Projects." Save the project with a name and a description. The project can be edited using the "Actions" section. Add an hourly rate under "Add Billings & Hours." Save the settings after estimating the project's costs.

Step 3: Install the desktop application.

Click "More" then "Get" on the Apploye website to download the desktop application. Select the Download button. The Application automatically detects your OS system. Install the Application by selecting "Get Apploye for (OS)".

Step 4: Start tracking time with the desktop application

Time tracking is started by clicking "Start Tracking." You must choose a project before you can log time.

Step 5: Timesheets are automatically updated.

Daily, weekly, monthly, and custom timesheets are displayed by Apploye.

Step 6: Export reports in CSV and Excel

Download reports such as Time and Activity, Manual Time, and Apps & URL Usage from your dashboard's "Reports" section.

Conclusion

Hiring independent employees is a cost-saving decision for your business, giving you access to a diverse talent pool. Yet paying them is still a monumental task given the recondite procedures and estimated related complicacy.

Use Apploye to keep the contractors under your monitoring umbrella and use help from this article. May the odds ever be in your favor!